Myths About Tax Audits - What's True and What's Not?

The word “audit” can send shivers down the spine of even the most diligent business owner. But tax audits aren’t as mysterious—or as terrifying—as many people think. Let’s bust some common myths and clarify what’s really true.

Myth 1: Only Businesses That Do Something Wrong Get Audited Truth:

Audits aren’t always triggered by wrongdoing. The IRD uses random selection, data matching, and risk profiling to choose audit candidates. Even businesses with clean records can be audited.

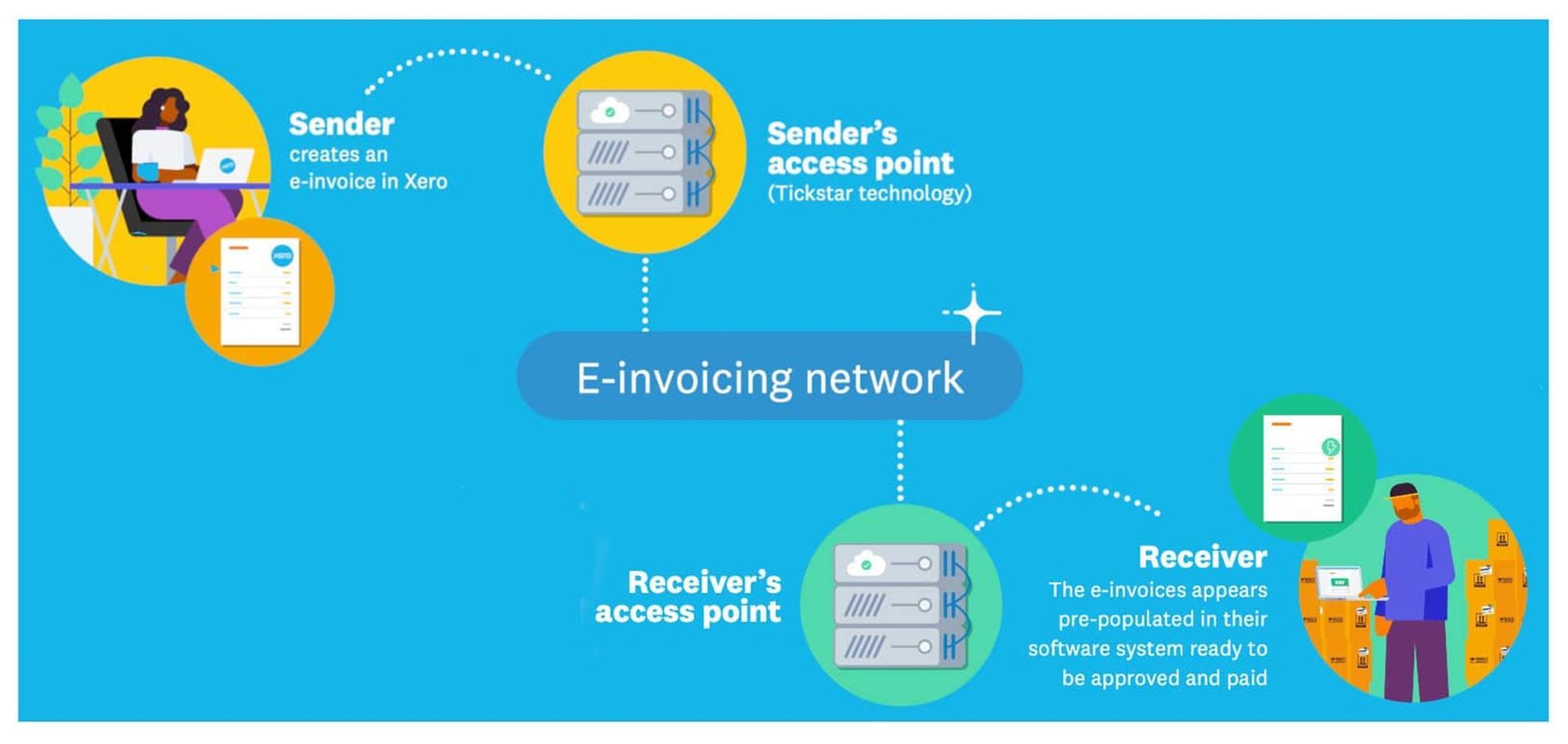

Myth 2: If You Use Accounting Software Like Xero, You’re Safe From Audits Truth:

Using software like Xero helps keep your records organised, but it doesn’t make you immune. The IRD still expects accurate data entry, proper categorisation, and supporting documentation.

Myth 3: Audits Are Always a Nightmare Truth:

Audits can be stressful, but they’re manageable—especially if your records are in order. With a good accountant by your side, audits can be handled efficiently and professionally.

Myth 4: You’ll Be Fined Automatically If You’re Audited Truth:

An audit doesn’t automatically mean penalties. If errors are found, the IRD may issue reassessments or request corrections. Penalties typically apply only in cases of negligence or intentional non-compliance.

Myth 5: You Don’t Need to Keep Records If You’re Not Making Much Money Truth:

All businesses—regardless of size—must keep accurate records for at least seven years. This includes invoices, receipts, bank statements, and payroll records.

Final Thoughts:

Tax audits aren’t something to fear—they’re part of a healthy tax system. The best defence is good preparation: accurate records, timely filings, and a trusted accountant who knows your business.

A Timely Reminder: Consider Audit Shield Insurance

Even with the best preparation, audits can still happen. Audit Shield Insurance provides peace of mind by covering the professional fees associated with responding to an audit, review, or investigation instigated by the IRD.

It’s a smart way to protect your business from unexpected costs and ensure you have expert support when you need it most. If you haven’t already considered Audit Shield, now is a great time to talk to your accountant about whether it’s right for you.