Business Plus One Blog

Common Accounting Mistakes and How to Avoid Them Accounting is the backbone of any successful business. Accurate financial records help you make informed decisions, stay compliant with tax laws, and maintain healthy cash flow. Yet, many businesses—especially small ones—fall into common accounting traps that can lead to costly errors. In this post, we’ll explore the most frequent mistakes and practical steps to avoid them. 1. Mixing Personal and Business Finances The mistake: Using the same bank account for personal and business transactions. Why it matters: It makes tracking expenses and profits difficult, complicates tax filings, and can raise compliance issues. How to avoid: Open a dedicated business bank account. Use accounting software to separate and categorize transactions. 2. Ignoring Cash Flow The mistake: Focusing only on profit without monitoring cash flow. Why it matters: A business can be profitable on paper but still run out of cash, leading to missed payments or insolvency. How to avoid: Regularly review cash flow statements. Forecast future cash needs to prepare for slow periods. 3. Misclassifying Expenses The mistake: Incorrectly categorizing expenses or failing to distinguish between capital and operational costs. Why it matters: Misclassification can distort financial reports and lead to tax issues. How to avoid: Learn the basics of expense categories. When in doubt, consult an accountant or use software with built-in guidance. 4. Not Reconciling Accounts The mistake: Skipping monthly reconciliations for bank and credit accounts. Why it matters: Errors and fraud can go unnoticed, resulting in inaccurate balances. How to avoid: Schedule monthly reconciliations. Use automated tools to match transactions quickly. 5. Forgetting About Tax Deadlines The mistake: Missing filing dates or underestimating tax obligations. Why it matters: Late filings lead to penalties, interest, and unnecessary stress. How to avoid: Set calendar reminders for tax deadlines. Use accounting software with tax compliance features. 6. Overlooking Depreciation The mistake: Not accounting for depreciation on assets. Why it matters: Inflates profits and misstates asset values, which can affect tax and investment decisions. How to avoid: Apply the correct depreciation method for each asset. Update records regularly to reflect changes. 7. DIY Accounting Without Expertise The mistake: Trying to manage complex accounting tasks without professional help. Why it matters: Small mistakes can snowball into major financial problems. How to avoid: Invest in reliable accounting software. Hire a qualified accountant for reviews or ongoing support. Final Thoughts Accounting mistakes are common, but they’re avoidable with the right systems and habits. By separating finances, monitoring cash flow, and seeking expert advice when needed, you’ll keep your business financially healthy and compliant. Tip: If you’re feeling overwhelmed, consider outsourcing your accounting or using cloud-based tools that simplify the process.

Starting or running a business without a plan is like heading out on a road trip with no map—you might get somewhere, but probably not where you wanted to go. A good business plan helps you figure out where you're going, how you’ll get there, and what you’ll need along the way. It’s not just about writing things down. Planning helps you get clear on your goals, your customers, and how you’ll make money. It’s a chance to think through your ideas, spot any gaps, and make smarter decisions. Having a plan also keeps you on track. When things get busy or unexpected stuff pops up (which it always does), your plan helps you stay focused and avoid getting sidetracked. It’s like having a compass when things get messy. Money-wise, planning helps you understand your costs, forecast your income, and avoid nasty surprises. It’s also super useful if you’re looking for funding—investors and banks love a solid plan. And if you’ve got a team, a business plan helps everyone stay on the same page. When people know what the goals are and how they fit in, they work better together. Bottom line? You don’t need a fancy document. Just take the time to think things through, write it down, and keep it updated. It’ll make a big difference.

The word “audit” can send shivers down the spine of even the most diligent business owner. But tax audits aren’t as mysterious—or as terrifying—as many people think. Let’s bust some common myths and clarify what’s really true. Myth 1: Only Businesses That Do Something Wrong Get Audited Truth: Audits aren’t always triggered by wrongdoing. The IRD uses random selection, data matching, and risk profiling to choose audit candidates. Even businesses with clean records can be audited. Myth 2: If You Use Accounting Software Like Xero, You’re Safe From Audits Truth: Using software like Xero helps keep your records organised, but it doesn’t make you immune. The IRD still expects accurate data entry, proper categorisation, and supporting documentation. Myth 3: Audits Are Always a Nightmare Truth: Audits can be stressful, but they’re manageable—especially if your records are in order. With a good accountant by your side, audits can be handled efficiently and professionally. Myth 4: You’ll Be Fined Automatically If You’re Audited Truth: An audit doesn’t automatically mean penalties. If errors are found, the IRD may issue reassessments or request corrections. Penalties typically apply only in cases of negligence or intentional non-compliance. Myth 5: You Don’t Need to Keep Records If You’re Not Making Much Money Truth: All businesses—regardless of size—must keep accurate records for at least seven years. This includes invoices, receipts, bank statements, and payroll records. Final Thoughts: Tax audits aren’t something to fear—they’re part of a healthy tax system. The best defence is good preparation: accurate records, timely filings, and a trusted accountant who knows your business. A Timely Reminder: Consider Audit Shield Insurance Even with the best preparation, audits can still happen. Audit Shield Insurance provides peace of mind by covering the professional fees associated with responding to an audit, review, or investigation instigated by the IRD. It’s a smart way to protect your business from unexpected costs and ensure you have expert support when you need it most. If you haven’t already considered Audit Shield, now is a great time to talk to your accountant about whether it’s right for you.

In today’s digital world, tools like Xero have made managing business finances easier than ever. With automated invoicing, real-time bank feeds, and sleek reporting dashboards, it’s tempting to think you can handle it all yourself. But here’s the truth: Xero is powerful—but it’s not a replacement for an accountant. Let’s break down why. 1. Tax Compliance and Strategy Xero tracks your income and expenses, but it doesn’t know your business like an accountant does. An accountant ensures: You’re claiming all eligible deductions GST and income tax are filed correctly and on time You’re not overpaying or underpaying tax They also help you plan ahead , so you’re not caught off guard at year-end. 2. Business Advice You Can Trust Xero shows you the numbers. Your accountant helps you understand what they mean. From cash flow forecasting to budgeting and pricing strategies, accountants offer insights that help you make smarter decisions and grow your business with confidence. 3. Handling the Complex Stuff Running a business isn’t always straightforward. If you’re dealing with: Trusts or multiple entities Asset purchases or sales Payroll and employment compliance An accountant ensures everything is done correctly and in line with IRD requirements. 4. Peace of Mind Even with Xero, mistakes can happen. An accountant reviews your records, corrects errors, and ensures everything is audit-ready. That’s peace of mind you can’t put a price on. 5. Time Is Money Your time is best spent running your business—not buried in spreadsheets. Let Xero handle the day-to-day and let your accountant handle the big picture. In Summary Xero is a fantastic tool, but it works best when paired with a knowledgeable accountant. Together, they help you stay compliant, make informed decisions, and grow your business with confidence.

In today’s fast-paced business world, many entrepreneurs and leaders are turning to business coaches/advisors for guidance. But is it worth the investment?

Yes—if you want clarity and accountability.

A good business coach/advisor can help you define your goals, sharpen your strategy, and stay accountable. They bring an outside perspective, challenge your assumptions, and help you see blind spots. For new business owners, this can be invaluable—especially when navigating growth, leadership challenges, or market shifts.

Yes—if you’re stuck or scaling.

Human Resources (HR) is essential to building a productive, compliant, and an engaged workforce to achieve business objectives. Here are the core HR functions every business should understand: 1. Recruitment & Hiring Attracting and selecting the right talent is critical. This includes creating accurate job descriptions and conducting structured interviews to ensure a good fit for both the role and company culture. 2. Compliance & Policies HR ensures the company follows labour laws and regulations, from minimum wage requirements to anti-discrimination laws. Clear, well-communicated policies help protect both employees and the organization. 3. Remuneration & Benefits HR manages payroll, benefits, and reward systems to ensure fairness and competitiveness, which are essential for employee retention and satisfaction. 4. Training & Development Continuous learning is vital. HR coordinates training programs to upskill employees and develop leadership within the organisation. 5. Performance Management Regular feedback, performance reviews, and goal-setting help drive productivity and align individual efforts with business objectives. 6. Employee Relations HR addresses workplace issues, promotes open communication, and helps build a positive organisational culture. Strong HR practices are key to long-term business success—because when people thrive, so does the business. Whether you're running a small business or a growing company, investing in HR is investing in your people—and your future.

The Small Business Cashflow (Loan) Scheme (SBCS) was designed to assist small to medium businesses and organisations that faced revenue loss due to COVID-19. The repayment period for the loan is five years (60 months) starting from the date the loan was issued. Since the scheme opened on 12 May 2020, businesses that took advantage of this loan early on are nearing or may already be at their repayment deadline. If the loan is not repaid by the due date, the Inland Revenue Department (IRD) will consider you in default and may impose penalty interest. If you are uncertain about your status or need to discuss this further, please feel free to reach out to one of our advisors.

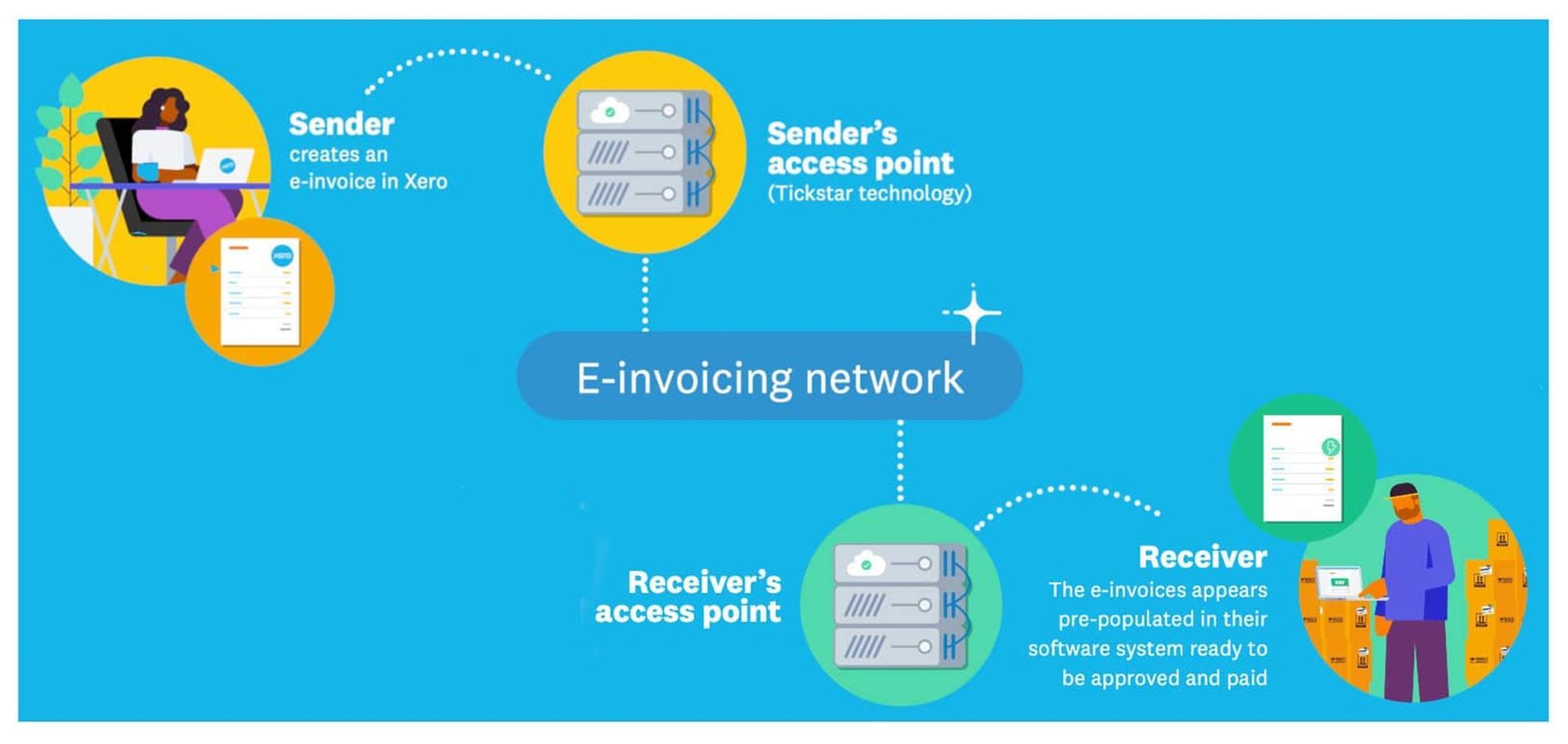

Do you know what eInvoicing is? Have you heard about? eInvoicing is the digital exchange of invoice information directly between buyers’ and suppliers’ financial systems. The invoice passes through the invoicing network where it validates information like NZ Business number (NZBN). Once the invoice is in the buyer's financial system it is reconciled against purchase details and ready to be paid. The NZBN number is the key to ensure that this invoice reaches the correct destination. The use of eInvoicing means businesses no longer need to generate paper-based PDF invoices to supply to their customers, and the customer no longer needs to manually load these details into their financial system. eInvoicing improves accuracy, efficiency, security and proven to speed up payments. Benefits - Faster payment and improved cash flow Reduced admin Reduced processing costs Direct and secure information Universal connection Improved financial visibility Available to any business Improving our economy Inland Revenue introduced new laws which took effect 1 April 2023 on minimum records required to support figures in your GST returns, this was to support the move to eInvoicing. Before long eInvoicing will become the new standard. For most businesses, getting set up only takes a few minutes, for step-by-step guides to get set up, follow the link below. https://www.einvoicing.govt.nz/einvoicing/what-is-einvoicing Find out who is registered by following the link below https://www.einvoicing.govt.nz/peppol